Whether you are domiciled for tax purposes in France or abroad, Sacem has prepared a tax certificate for the author's rights paid to you in 2017, to help you complete your tax return.

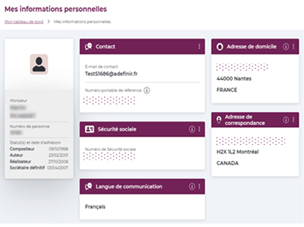

You can see this tax certificate on sacem.fr, in your secure membership account/My dashboard/My distributions/My royalties certificates for tax purposes.

It is your responsibility to check these items and update them, if necessary, with any other sources of income that you have and any expenses incurred during the year. Of course, you remain solely responsible for declaring your income and the amounts involved.

Are you domiciled in France for tax purposes, and do you declare your income to the French tax authorities?

Sacem has modified the certificate to help you determine the amount that needs to be declared, according to the applicable tax system.

New changes for the 2017 income tax return

You declare your author's rights under the 'earnings' category:

Until last year, authors' rights were included in box 1 AJ, together with any other income to be declared in this category (wages, fees, etc.)

This year, taxable authors' rights received (from Sacem + any other sources) must be declared, separately from any other income received as wages, in the new box labelled1 GB on the 2017 income tax return.

Reminder: Only creators are entitled to declare their authors' rights in the "Wages and salaries" category. All other holders, such as the creators heirs, are not allowed to declare their author's rights in this category.

You declare your authors' rights as Non-Commercial Profit:

The "micro-BNC" scheme gives you a 34% flat rate allowance for costs as calculated by the tax authorities. Under this scheme, you must declare the gross amount (ex-VAT) earned from authors' rights of any kind (Sacem + any other sources) without deducting expenses (including social security contributions).

Starting with the 2017 income tax return, the VAT exemption, which was applicable in previous years, has been removed. The micro-BNC scheme is applicable regardless of the gross amount of authors' rights, ex-VAT, for the year 2017, if:

- The gross amount of authors' rights, ex-VAT, for the year 2016 was less than €70,000

or - The gross amount of authors' rights, ex-VAT, for the year 2015 was less than €70,000

Are you are domiciled abroad for tax purposes?

Sacem has drawn up a certificate stating the gross amount of authors' rights credited to your account in 2017 and, if applicable, the amount of withholding tax deducted from your rights, and the net amount, after the deduction of the withholding tax.

Published May 14 2018